maine excise tax credit

Hard Cider - 035gallon Sparkling Wine - 124gallon 1. Overpayment from previous month.

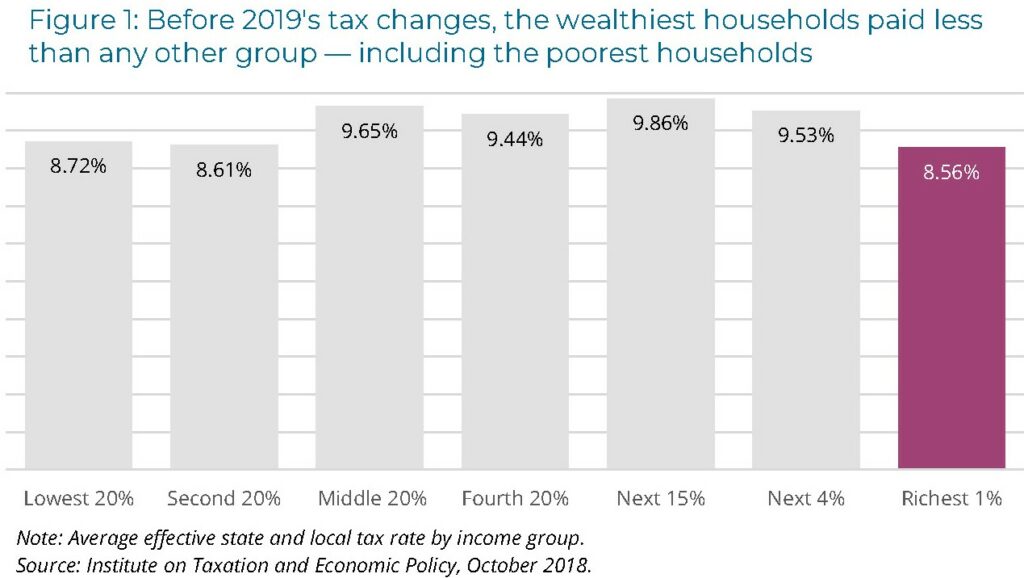

Fair Taxes Maine People S Alliance

Credit for Rehabilitation of Historic Properties offsite Student Loan Repayment Tax.

. Total Credits Claimed attach documents to justify claim 2. Learn more Property Tax. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the.

18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. Excise Tax Credit Summary Report Rev. Excise Tax Credit Summary Report Rev.

Find your Maine combined state and local tax rate. Qualified businesses may receive reimbursement of up to 80 of Maine income taxes withheld for employees under an approved ETIF program for up to 10 years. The law provides that excise tax declines over the first six years of the vehicles life and is calculated as follows.

The minimum tax is 5 for a motor vehicle other than a bicycle with motor attached 250 for a bicycle with motor attached 15 for a camper trailer other than a tent trailer and 5 for a tent. Knowingly supplying false information on this form is a Class D Offense. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise.

The maine eic is available to maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal form 1040 or form 1040-sr or who are otherwise eligible to. 6 hours ago Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicleEnter your vehicle. Knowingly supplying false information on this form is a Class D Offense.

Be it enacted by the People of the State of Maine as follows. Beginning April 1 1984 upon payment of the excise tax the municipality shall certify on forms provided by the Department of Inland Fisheries and Wildlife. Title 36 1504 Excise tax.

On - Session - 127th Maine Legislature. Excise Tax Credit Summary Report. Title 36 1482 Excise tax.

Except as provided in subsection 2-a the in-state manufacturer or importing wholesale licensee shall pay an excise tax of 60 per gallon on all wine other than sparkling wine fortified wine or. Excise Tax Credit Summary Report Rev. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Knowingly supplying false information on this form is a Class D Offense. Excise Tax Calculator Bar Harbor Maine. Excise Tax Credit Summary Report.

First year 2400 per 1000 of MSRP. The purpose of the tax is to partially offset the costs of forest. An Act To Allow a Motor Vehicle Excise Tax Credit for a Vehicle No Longer in Use.

The Maine Sales Tax Fairness Credit is a refundable income tax credit for eligible Maine residents. Second year 1750 per. Excise Tax Credit Summary Report.

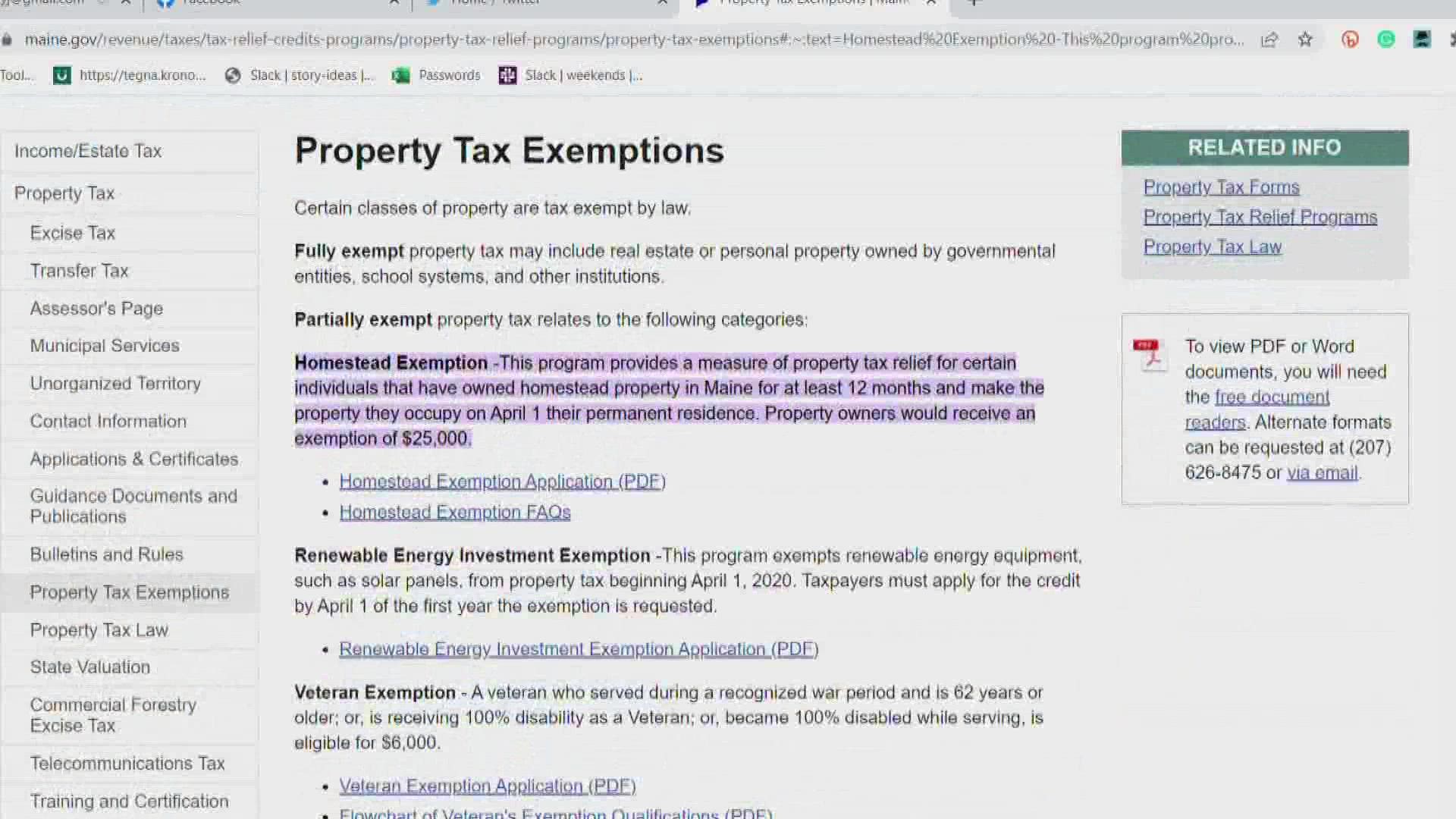

Total Excise Tax Due 1. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the. For the privilege of operating a motor vehicle or camper trailer on the public ways each motor vehicle other than a stock race car or each camper trailer to be so.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident.

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Maine Reaches Tax Fairness Milestone Itep

Maine Income Tax Does Not Conform To Ffcra And Cares Act

Excise Tax Information Cumberland Me

It Is A Pickup Truck At Least In Maine It Is Hyundai Santa Cruz Forum

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com

New York Holds End Of Lease Adjustments On Fleet Vehicles Cannot Give Rise To Sales Tax Refund Salt Shaker

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation

Maine Military And Veteran Benefits The Official Army Benefits Website

Maine Tobacco Vaping Tax Increase Proposal Tax Foundation

Business Equipment Property Tax Relief Programs Betr Bete Maine Revenue Services Property Tax Division August 2 Ppt Download

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Free Maine Boat Bill Of Sale Form Pdf Word Rtf

2022 State Tax Reform State Tax Relief Rebate Checks

Every Electric Vehicle Tax Credit Rebate Available By State

Maine Sales Tax On Cars Everything You Need To Know

Two State Of Maine Beer Excise Tax Stamps One Pint S133 Ebay

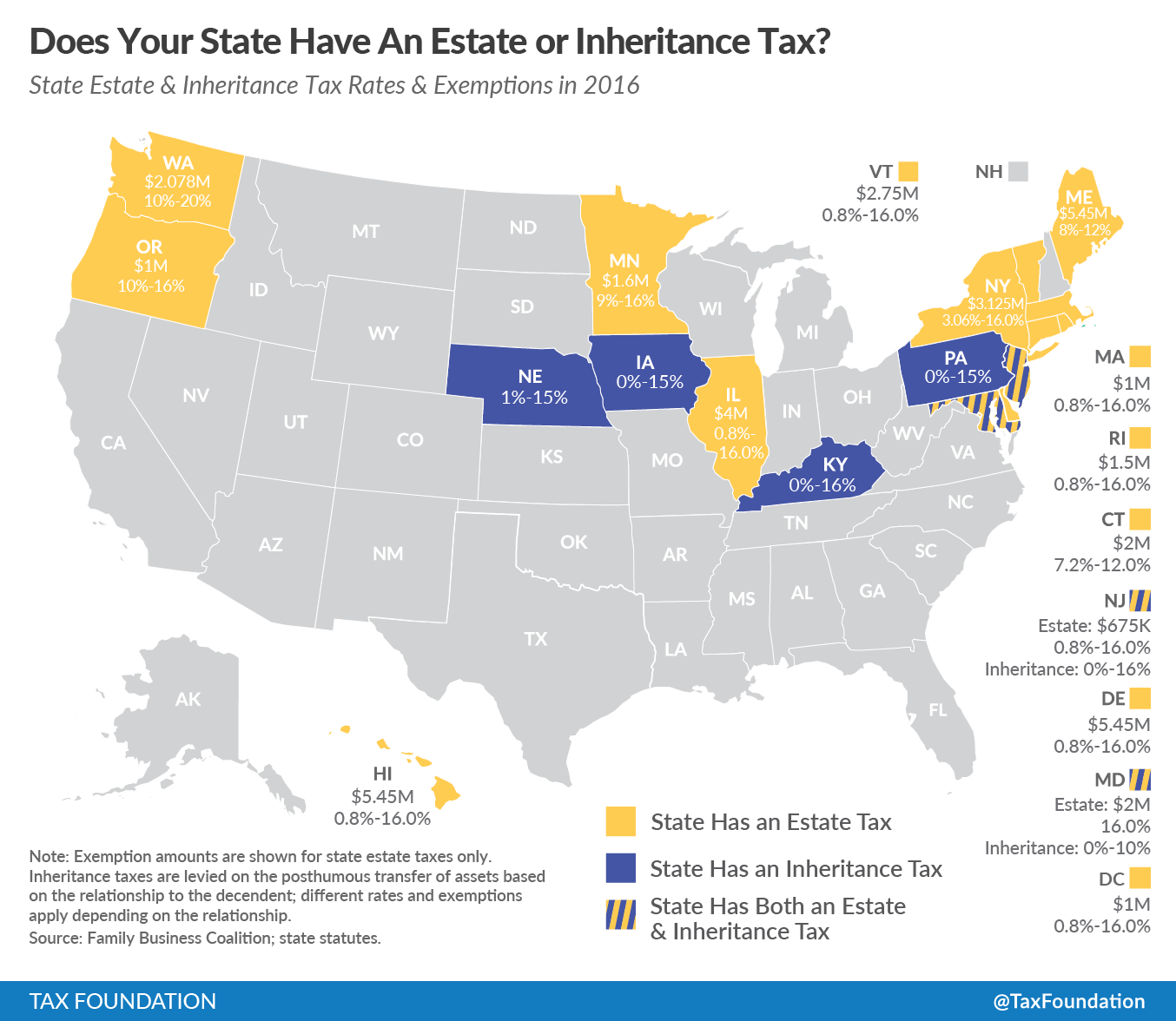

How Do State And Local Property Taxes Work Tax Policy Center